Other

Ryter

Articles:

The Two Kerry's:

War Hero or

Traitor?

"Men in Black" The Cult of The Judges

FUDGING

THE BELLWETHER

By Jon Christian Ryter

August 13, 2007

NewsWithViews.com

America is a nation of financial checks and balances. It's been that way since May 17, 1792 when the New York Stock Exchange was formed. Twenty-four stock brokers met under a buttonwood tree outside of 68 Wall Street in New York and signed what became known as the Buttonwood Agreement. The official New York Stock Exchange building opened at 18 Broad Street on April 22, 1903.

After the 1929 stock market crash, the newly created Securities Exchange Commission, working with the NYSE management, unveiled a fifteen-point program aimed at restoring confidence in the market. With a ton of newly enacted banking laws to contend with�most of which were designed to increase transparency in the securities marketplace�increased secrecy under the guise of providing transparency became the rule of the day.

Over the last two decades the moneymen at 18 Broad Street, together with the moneymen at 120 Broad Street and in the central banks of Europe, have become even more secretive in how they manipulate the volatile global markets in order to make them appear healthy as their century old objective of creating a cohesive world government appears to be within their grasp.

As the transnational industrialists, the barons of business and the merchant princes played ping pong with US jobs and US factories as the Bill and Hillary Clinton-orchestrated NAFTA job drain began in 1993, it was necessary to find a way to artificially inflate the US economy to make it appear that America could surrender millions of middle class jobs and maintain economic stability at home. The job drain was necessary to bring the human capital-rich third world into the 21st century, and to create�for the barons of business and the merchant princes�the product-starved consumers of the New World Order who would be able to buy their wares at the expense of working class stiffs throughout the United States.

As the United States workforce was being downsized, and the personal net income of the working class household was shrinking, the stock market miraculously continued to grow�one of the bellwethers of a healthy economy. At the same time, another bellwether of the state of the economy�Gross Domestic Product�was shrinking even though, theoretically, from 2003 to the end of 2005, 5.7 million jobs were added to what was touted as a robust economy. The statistics, cited in a Council of Economic Advisers report to the US Senate Budget Committee on Sept. 28, 2005, offered yet another bellwether statistic to suggest all was well in America's heartland�unemployment. Edward Lazear, Chairman of the CEA, noted that latest job report (issued in August for the previous six months) showed the unemployment rate, which had been 5.1%, declining to 4.7%�another sign of a healthy economy. Lazear noted also that there was nominal wage growth over the past year, with an annualized rate of 4.1%.

On top of all this good news, Lazear reported that from August, 2005 to August, 2006 there was a 22% increase in the price of crude oil and a 32% spike in the price of gasoline. High energy prices should strain the stock market and add undo financial stress on businesses�small and large. High energy prices burden the already strained incomes of working class families who usually feel the brunt of any economic malady before it impacts the stock market. As energy prices spiked upwards and the news media talked, once again, about $100 oil, the working class felt it immediately at the pumps and in utility commission-approved rate increases in their electric bills. But, not so much as a ripple in the stock market. Another bellwether that did not work.

For the last five years, as more small and medium-sized businesses in the United States were forced to close or move offshore because they couldn't compete with third world labor pools working for slave labor wages and more US workers either lost their jobs or were forced into early retirement with reduced pensions, discretionary spending�which impacts the bottom line of the merchant princes�nosedived. This should have softened the economy and impacted the market. It didn't. Still another bellwether that didn't work.

The money barons opened their checkbooks and birthed the housing boom in 1998 to conceal the weakness of the economy. The mortgage banking industry, with the financial help of Wall Street and the blessings of the Federal Reserve System, got creative in making new homes affordable�to everyone. Even those whose credit worthiness was questionable, who were denied home ownership in the past, were given mortgages. High interest subprime mortgages, financed by speculators who liked the returns on the subprime bond issues, were the latest investment fad. So were the exotic ARM mortgages that allowed home buyers purchase far more house than they could afford. And, as the subprime investment bankers hosed first time subprime new home buyers as well as those moving up in the neighborhood, they hosed them again with subprime credit cards to furnish and decorate those new homes. Credit cards whose interest rates doubled when you were late with your payments�even your phone bill�as credit card companies tied the interest rate on existing credit cards to the cardholder's credit score.

And, then to make sure the homeowners could not escape the debt overload caused by their loose credit policy, the bankers demanded that the consumer bankruptcy laws be changed to make sure their customers could not bankrupt their way out of the massive debt they were now carrying. Saddled with high-interest debt on loans whose minimum payments were eating the bulk of their take-home pay, a growing number of debtors no longer had any discretionary income to speak of. Many, in fact, don't have enough after-tax wages to make their mortgage payment, pay their utility bills and feed their families let alone make their credit card payments.

As a result, many middle income breadwinners are forced to work two, three or more jobs to keep from drowning in debt. Many ultimately face the decision to put the family home up for sale or risk losing it in a foreclosure. Sadly, for far too many Americans today, their dream home has become the nightmare on Elm Street, and the mortgage company has become Freddie Kruger. Adding to their woes, the economy is decelerating. That means the extra jobs that are helping many families make it each month are slowly disappearing�or the wages offered for those part-time jobs are shrinking as illegal aliens, working for half to 75% of what taxpaying US citizens earn, take those benefitless jobs from American wage-earners who, by the nature of their citizenship, are entitled to them.

Rising oil prices last year triggered a spike in interest rates that sent shivers into the housing boom, ultimately collapsing it and starting an economic domino affect rippling through the nation. If the stock market was the only indicator you were watching, the economy continued to look robust and healthy. The bellwethers simply didn't work. The economy was tanking but nobody noticed even though the economic indicators have been in flux since 1994�the year after NAFTA began its job drain in the United States. And, the indicators�the bellwethers that signal when something's wrong with the economy�are sending mixed signals that suggest someone's fudging the numbers.

Unemployment is at a low 4.6% but the job drain continues. On top of that, imports from China and other third world nation are responsible for most of the products for sale in America's retail shopping malls and supermarkets. So, what are happened to the US workers who used to make the goods that filled America's retail establishments? Most of them are unemployed. Many of those who were forced into premature retirement used their 401Ks to start home-based businesses. Some collected unemployment until the benefits ran out. Once the benefits run out, they were dropped from the unemployment statistics since the only people the Department of Labor counts as "unemployed" are those who are collecting benefits from either the State or the federal government. Once their benefits run out, they are deemed to be no longer "unemployed" even if they don't have a job. If the government tracked people until they found work, we would discover our unemployment rate in the United States is somewhere between 12% to 18%�if not higher. Uncle Sam deliberately fudges on the unemployment bellwether to make the economy look healthier than it is.

America is facing a catastrophic economic crisis much worse than 1929. New home starts are down 20% from 2006, which was down about 15% from 2005. Federal Reserve Chairman Ben Bernanke warned that housing will continue to be a drag on the economy into 2008�even if everything else turns around. A statement like that ten years ago would have set the market in a tailspin. Instead, the market closed up.

Housing, as a catalyst to boost the economy, is not just in the doldrums�we read its obituary in the morning paper every day. Marsha Elliott, president of Terrestris Development Co, a midsize residential home developer in Chicago, noted that the housing downturn is weird because, she said, its not being pushed by the fundamentals you expect�like rising interest rates or a bad job market. In part, she's correct. But, basically she's wrong. The US job market has been tanking for a decade. Its evisceration by NAFTA has been successfully camouflaged by the past two administrations. The job market in the United States is not healthy because the new jobs being created in this economy are Band-Aid jobs, and the American workforce is the walking wounded. One more bellwether that was unplugged by Bill and Hillary Clinton that remains artfully camouflaged by Bush-43.

Douglas Duncan, the chief economist for the Mortgage Bankers Association believes the collapse of the housing boom stems from the lack of buyers of mortgage-backed securities due to risk of subprime mortgage defaults. Thus most of the subprime mortgage money has dried up. The exotic mortgage that let buyers qualify for homes they couldn't afford, are gone. So is the ability to get into a new or existing home without a substantial down payment. As reality sinks into the real estate market, the exaggerated home values that provided the equity that allowed existing home owners to sell and "move up" into a more lavish suburban home, or extract equity from their home to buy other consumer products, has pretty much dried up. Duncan is partially correct as well. The reason the housing boom exploded is greed. Greedy mortgage-loan brokers who oversold buyers they knew could not afford the mortgages they were buying; greedy banks that believed they would profit phenomenally from the equity in these homes when they foreclosed or when the homeowner would be forced to refinance their mortgages over and over again; and most of all, a greedy government that was using them as human capital pawns to conceal the damage that NAFTA was doing to the economy of the United States.

Bernanke,

whose outlook on housing is not upbeat, optimistically insists there's

nothing really wrong with  the

economy. He mitigates the volatility of the market by insisting the

problems in the housing sector have not spilled over into other areas.

Consumer

spending�which drives the economy�has held the economy together since

the housing boom tanked, But spending is slowing, and will slow even

more later this year. Oil will drive up prices and increased household

expenses will continue to reduce the amount of discretionary income

available.

the

economy. He mitigates the volatility of the market by insisting the

problems in the housing sector have not spilled over into other areas.

Consumer

spending�which drives the economy�has held the economy together since

the housing boom tanked, But spending is slowing, and will slow even

more later this year. Oil will drive up prices and increased household

expenses will continue to reduce the amount of discretionary income

available.

Bernanke dismisses the bellwethers even more when he says: "We drive. We eat. We understand that inflation involves all prices, not just those that are not volatile." Death, taxes�and rising interest rates are a fact of life.

So who's manipulating the bellwethers? Every now and then, the manipulation is "caught on tape."

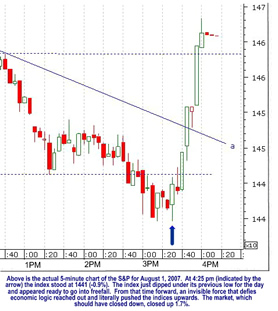

It happened on Wed., Aug. 1, 2007 at 3:25 pm, EDT. The market was dropping rapidly. It stood at 1441�(-0.9%) and appeared to be in a tailspin. At 3:25, it dropped below its previous low . Then, with nothing going on in the economy to trigger an upturn, in the last 35 minutes of the day, the S&P rose 150 points, ending the day with a 0.7% gain.

Overnight it appears buying continued until the NYSE opened on Wednesday. The S&P 500 exceeded its 200-day moving average on Wednesday morning when it hit 1450.38. This was the second attempt to keep the stock market from imploding. On Wednesday, Aug. 2, the Dow Jones fell in the morning, but what appears to be a second manipulation pushed those numbers up. It dropped again in the late afternoon, but a last-minute 30-handle SPU surge in 20 minutes brought the DJIA up 150 points saved it from falling below its June low of 4994 that would have triggered a sell-off on Thursday.

Mary Ramsey King, an American Indian who owns M. Ramsey King, Incorporated�a woman-owned and run security brokerage firm in Burr Ridge, Illinois�who has over 30-years experience in Institutional Trading with some of the nation's largest brokerage firms like Prudential-Bache, Bears Stearns and Smith Barney watched the yo-yo game on the big board. A M. Ramsey King spokesman noted that "...[t]here are only two reasons to buy SPUs up 30-handles in 30 minutes before the NYSE close is to frontrun Earth-shattering bullish news..." {which clearly wasn't happening) "...or to force [weak] stocks higher. A source," M. Ramsey King said, "told us that Goldman started the SPU buying frenzy about 34 minutes before the NYSE close. Then Citi joined, followed by Merrill and DBK."

It appears that several European brokerage houses, who were expecting the Dow to be trading off about 100 points on Wednesday because of reports that a Bear Stearns hedge fund was in trouble, oil hit an all-time high, and new mortgage applications fell to a 5-month low, were surprised when the Dow opened up about 50 points. The day, however, became a freakish roller-coaster ride. One London broker observed that "...[d]espite this, the Dow managed to trade either side of even for most of the day�until 3:25 p.m.[when it] staged a miraculous 200 point rally in the last half hour to up 150 points. Unbelievable. This is like Manchester United being down 1-0 with two minutes to go in the European Cup Final against Bayern Munich, or scoring a touchdown from the halfway line on a fourth down. This was a Hail Mary rally to end all Hail Mary rallies."

Everyone can speculate who did what and why on Wednesday, August 1, but the simple truth is whomever did it did it to keep the bottom from falling out of the good-luck bucket, starting a domino affect market crash that will end the Utopian dream of creating world government within the next decade or two. The market is trying to make one of those "dire consequence" corrections�a bellwether correction�that would have revealed just how frail and unhealthy the US economy is because of NAFTA, and the fact that there is no real GDP growth in the United States and a growing income inequality brought on by hiring illegal aliens at substandard wages to drive down the price of jobs in America. Add to that the fact that the Social Security Trust Fund is bankrupt and the US Treasury is bankrupt and you've got to wonder why the bellwethers stopped warning us to shift our investments from the stock market to some form of portable wealth to protect us from another 1929. Me? I'd be buying gold.

|

Subscribe to the NewsWithViews Daily News Alerts! |

(Author's

note:) It appears as if the NYSE finally felt the impact of the

housing implosion. On Thursday, Aug. 9, on heavy trading, all of the

market indices were hit and closed down. The NYSE Composite lost 294.72,

closing at 9,451.49. The DJIA lost 387.18, closing at 13,270.68. This

bellwether correction was nine days in the making.)

� 2007 Jon C. Ryter - All Rights

Reserved

[Read "Whatever Happened to America?"]

Sign Up For Free E-Mail Alerts

E-Mails

are used strictly for NWVs alerts, not for sale

Jon Christian Ryter is the pseudonym of a former newspaper reporter with the Parkersburg, WV Sentinel. He authored a syndicated newspaper column, Answers From The Bible, from the mid-1970s until 1985. Answers From The Bible was read weekly in many suburban markets in the United States.

Today, Jon is an advertising executive with the Washington Times. His website, www.jonchristianryter.com has helped him establish a network of mid-to senior-level Washington insiders who now provide him with a steady stream of material for use both in his books and in the investigative reports that are found on his website.

E-Mail: BAFFauthor@aol.com

Over the last two decades the moneymen at 18 Broad Street, together with the moneymen at 120 Broad Street and in the central banks of Europe, have become even more secretive in how they manipulate the volatile global markets...